Our 2026 outlook

Smart Building Insight - Partnerships, M+A, public firm developments - January 2026 from Aamidor Consulting

Letter from the Editor

First, Happy New Year! We have a bunch of news items to start 2026, and also our 2026 outlook on tap, below. Also check out a few other special features just below.

As for a quick rundown of the highlights:

See our 2026 outlook, with predictions and what we expect in the new year.

We’re soft-launching our smart building innovator leaderboard, also just below - take a look.

There were a fair number of acquisitions announced at the end of the year, including Resideo, Trane, Vertiv, Conservice and CannonDesign.

Just a few partnerships, including Kode Labs, Siemens, Leap and Enel.

A few public firm updates: Acuity and Signify

Quick side note, don’t forget to check out our podcast! Lewis Martin and Joe Aamidor host the “Down Low with Joe”, which focuses on market developments and includes interviews with RE decarb/digitization innovators. Check out our YouTube channel or Spotify.

Did you miss it? We soft-launched our startup leaderboard and are looking to refine it and then use it regularly to track the market. We’ve already heard from a few other firms that will be included in future iterations.

If you want to be included: please reach out with data that is publicly-available (press release, website, etc), which we can use to update your firm’s position.

Finally, a housekeeping item - our project calendar is filling up for Q1 2026 - please reach out if you think you will need our help (and note, we have a new project inquiry page). We’d be happy to talk - please get in touch soon!

Aamidor Consulting Client Spotlight

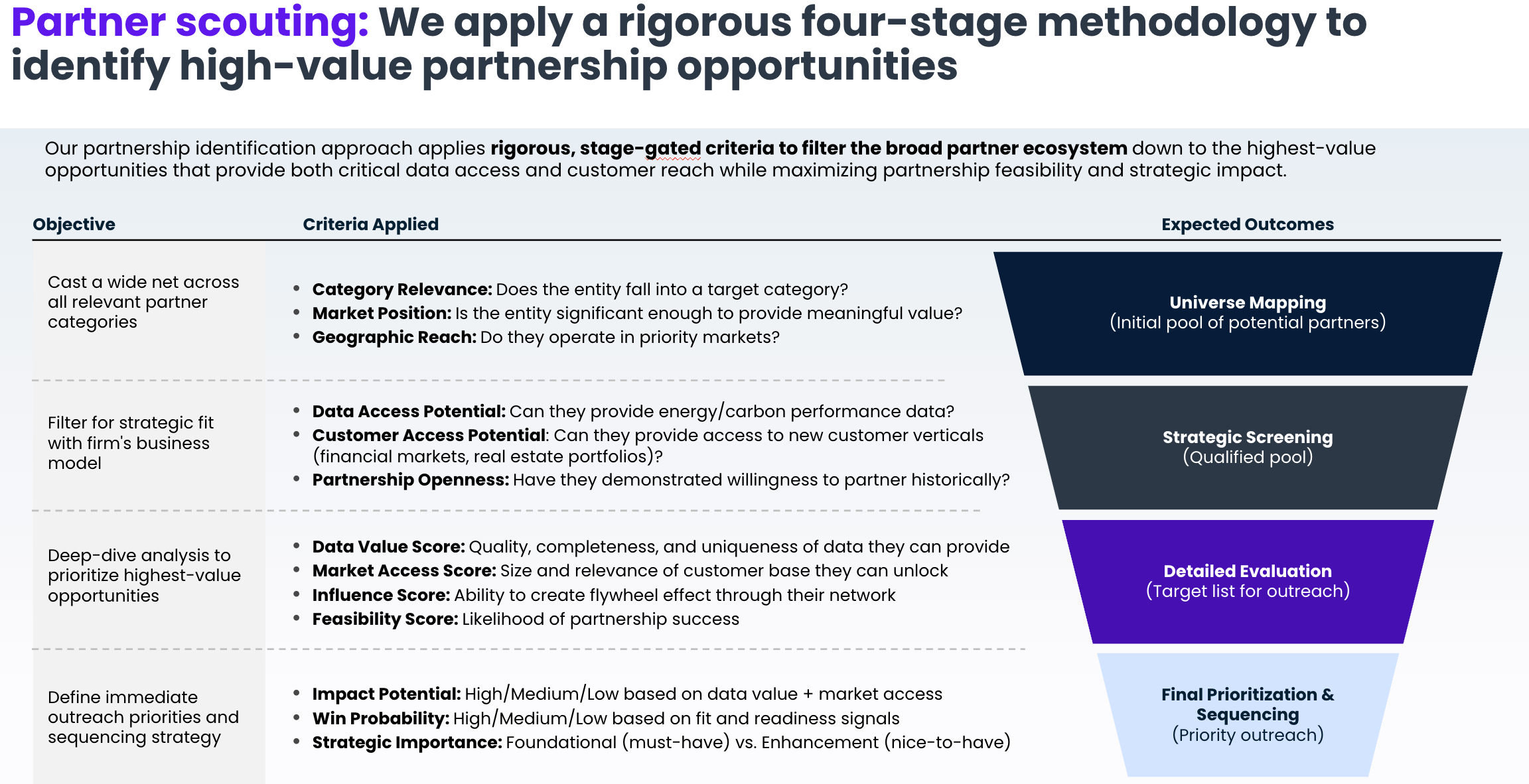

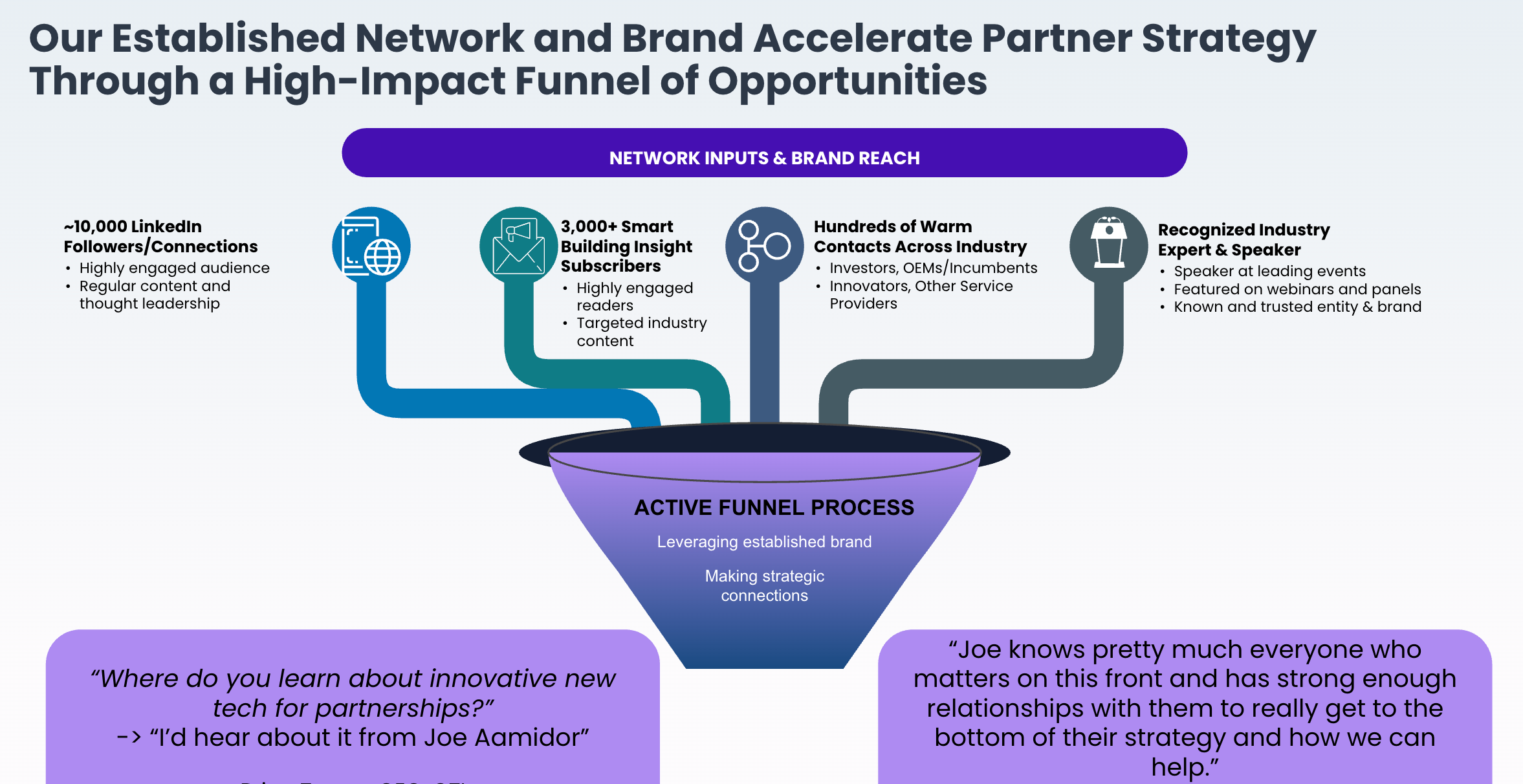

We continue to do a lot of partnership strategy and market landscape work in the industry - with larger incumbents, investors, smaller innovators and other stakeholders. We can quickly grow your network in the market, better target your pitch to prospective partners, and also help build a feedback loop that drives prospective partner feedback into the product roadmap. At the same time, firms looking to find prospective partners (or investment opportunities) can build their top of funnel much quicker when we are involved. See below for a quick slide highlighting part of our unique process to deliver value to smart building stakeholders.

This newsletter is a market wrap up and analysis of the smart buildings industry. If the email was forwarded to you, sign up to receive it directly.

Before we get into the other sections, did you see that we now have a “Resources” page to our newsletter homepage? This is for paid subscribers and includes: our M+A tracker, Partnership tracker, and some other materials coming soon. We hope you check it out (and use whenever you need some quick market data).

Market Analysis: 2026 outlook

Aamidor Consulting continues to provide insight to smart building innovators in this section. This month, our outlook for the new year.

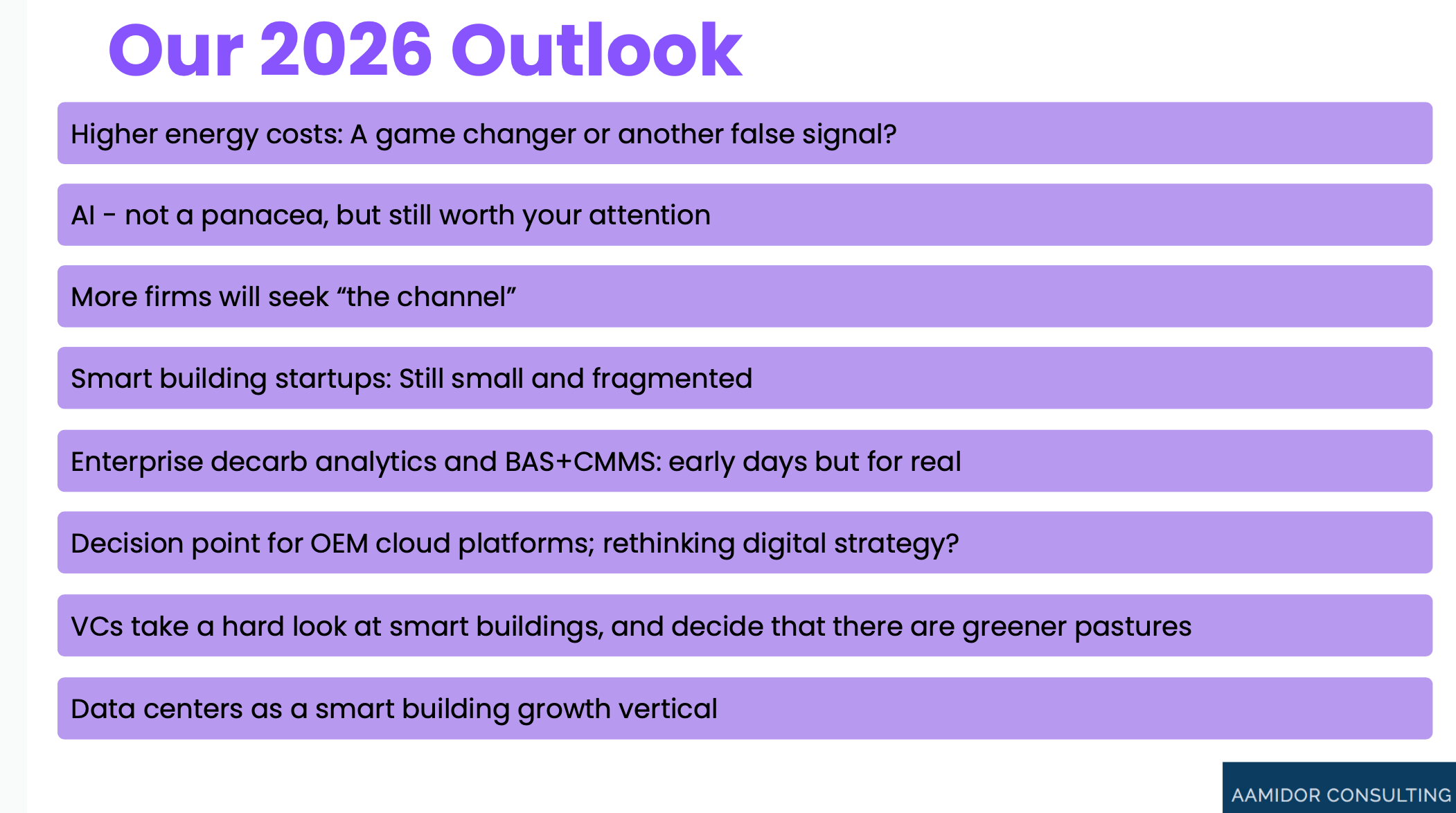

What’s going to happen this year in smart buildings? Even we don’t have a crystal ball, but we do have some strong views about the year ahead. We’re laying them out here - and would love to hear from you. Do you think we’re right? Or maybe we’re missing something?

High energy costs: A game changer or a false signal? There is an expectation that energy costs will rise, and in many locales, costs already have started to rise. At its face, that is good for smart building technology, as the higher costs should drive facility owners and operators to invest more in technology to reduce those costs. It’s also different from the past 10+ years, when many portfolio owners were happy to manage energy costs consistently (they would prefer to avoid wide swings over driving costs down incrementally each year). Now, if energy rates go up, costs will rise even if the buildings are managed consistently (energy use stays flat, costs go up). At the same time, we aren’t sure that this plays out and drives massive adoption of smart building and energy management solutions, and we’re even less sure that it drives consolidation in the market. The key dynamics: dozens of viable vendors and a perception of high switching costs - both of them likely keep the market in a similar state, even with a new driver to adopt this technology (see below for more of these dynamics). Additionally, we’re not sure energy rate increases will cause a massive shift to of building operators acquiring new technology to drive energy efficiency (though at the margins it may happen more frequently).

AI - not a panacea, but still worth your attention. We are long-term bullish on AI in our industry, but short-term skeptical, since there are plenty of barriers to adoption (e.g., data and organizational readiness). You can’t just switch off your attention to AI, but it probably won’t revolutionize building operations in 2026, either. We think there will continue to be a lot of funding and product innovation around AI, but there also will be plenty of marketing innovation (noise) among this. We think ‘baby steps’ is the right strategy for 2026.

More vendors will seek ‘the channel’. Vendors, take note - your go-to-market may need a refresh. There are many channels to market in smart buildings technology, but “the channel” typically refers to an indirect approach - through distributors and independent integrators, or master systems integrators, or just any third-party that has a relationship with a building owner/operator. The channel is mostly used for traditional HVAC and controls sales (though some software firms have also focused on selling their solutions through these channels. That has had mild success, though also has faced some challenges. For one, these channel partners may not be well equipped to sell software - which is a different approach than hardware and services. Additionally, most building systems are sold based on a well-established requirement (e.g., specification), and not necessarily an ROI. But software in our industry IS sold on the basis of ROI. All that said, we see 2026 as being an inflection point in the channel approach - specifically, selling to those channel partners for their own use, or to enable them to deliver better service to their end clients is where the market is maturing to. (And note, we have a standard offering focused on helping innovators think through partnership strategy - see here for a sneak peek, and contact us if you want to learn more.)