Special Issue! Big news from Smart Building Insight and Aamidor Consulting

Smart Building Insight - SPECIAL ISSUE - June 2025 from Aamidor Consulting

Quick update

This is a special issue to provide some updates on the future of the newsletter, and to give you a sneak peek of our updated format and approach.

We’re also pausing the usual newsletter for early June by 1 week, until June 8, so we can provide updates after Realcomm (which starts tomorrow - we look forward to seeing you there).

The headline: We’re moving Smart Building Insight to a paid model. We still will include a free excerpt for all readers every 2 weeks, and also will have some special free issues throughout the year.

This was a complex decision…we continue to see significant growth and engagement with this newsletter, and we also receive very positive feedback from readers. Moreover, we want to dedicate more time to producing an increasingly valuable periodical (it takes a lot of time!).

So, what will it cost? $180 / year, or $20 / month. However, we are running a promotion - 25 percent off for new subscribers.

Moreover, Aamidor Consulting clients will receive a free subscription - if you aren’t already signed up, please reach out to us and we’ll help you out.

And, with this change, we also plan to expand our coverage, including:

At least 6 special issues, in addition to the standard 2x per month. This is our first special episode, which digs into a few topics below…

A more regular and complete review of public OEMs, with a focus on their investments in technology and also M+A (actual and strategy). We will continue to flag interesting data points for market sizing and share analyses.

More guest posts. We receive a regular stream of great newsletter feedback from other market observers, in addition to reading other adjacent newsletters. We’d like to feature some of those analyses and thoughts in this publication. Smart Building Insight will continue to focus on the business and product strategy of smart buildings: technology to digitize and decarbonize real estate. If you have a topic, please reach out.

We also are considering other ideas, such as sponsored episodes, in which a vendor/solution provider can unlock a whole issue. Additionally, we like the idea of sponsored deep dives, where a vendor can provide some context on an offering, and we provide our independent, unbiased take on what they are doing. Contact us if these are interesting to you.

So, there will be more than just the standard 24 issues each year covering mergers/acquisitions, funding rounds, partnerships, and product launches.

Lastly, there are no changes to our core consulting business, so please reach out if you need our help.

Carrier Investor Day 2025

Carrier hosted its 2025 Investor Day, the first event of this kind since 2022. It covered the full business, but there are a number of interesting and relevant items for smart buildings.

First, Carrier is seeing significant growth in chillers. Historically, Carrier lagged behind Trane and York (JCI) - see these estimated from Credit Suisse in 2015 (yes, they are old, but its hard to get detailed market share data on chillers).

Credit Suisse in the same report also looked at sales, which includes a number of other key players, such as Daikin. While these data also are fairly old, we do believe that they are a directionally accurate representation of market shares.

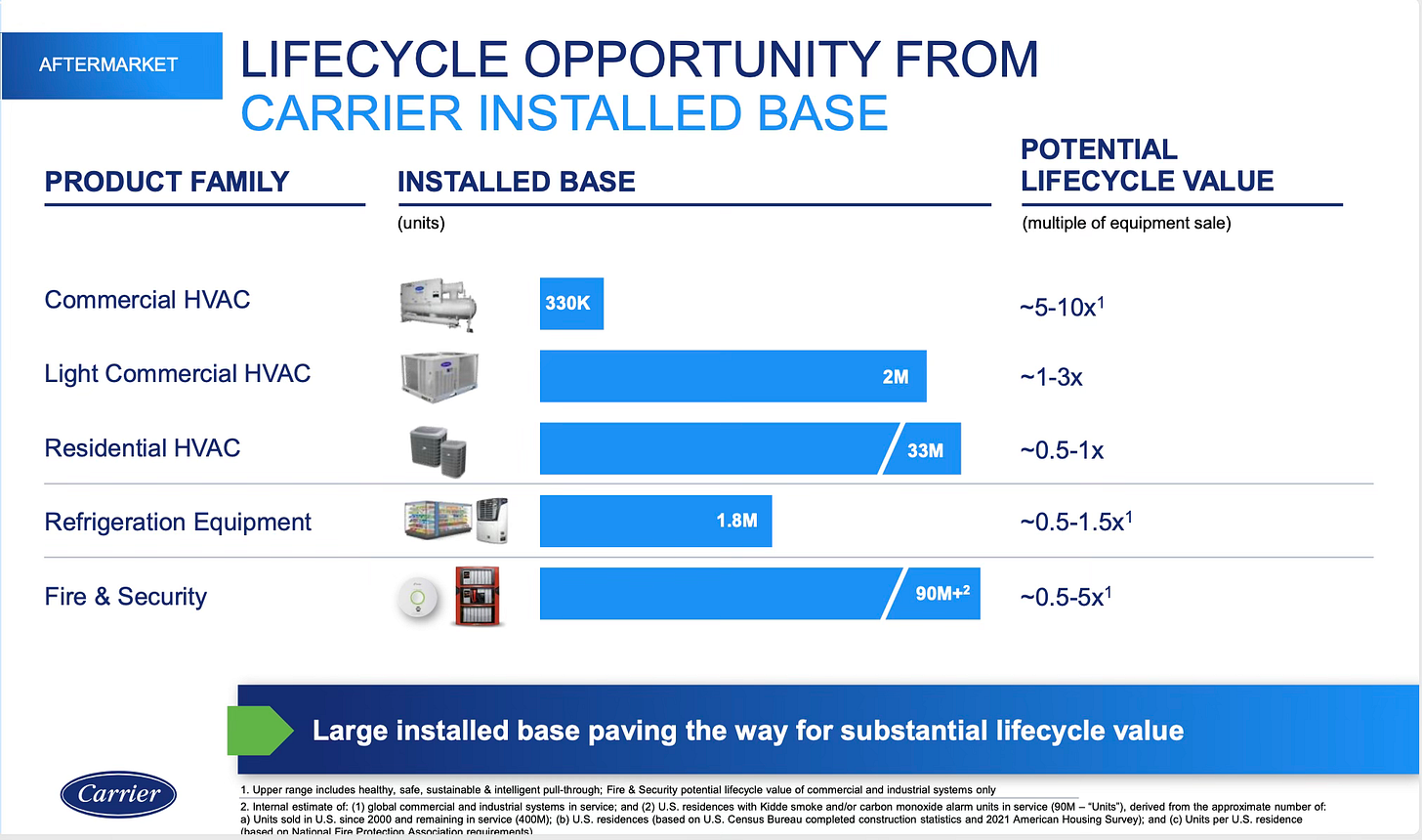

In 2022 Carrier cited ~330K chillers as its worldwide install base (and, note the lifecycle value multiplier, which is much higher than other HVAC equipment types).

Carrier has noted that data center growth gives them a “catch up” opportunity - the cooling demands of individual data centers means that any given OEM can sell a lot of chillers in a single project. It does look like this is paying off, as this year, Carrier’s installed base has grown to ~400K chillers. (Note: There’s also been a lot of growth on the light commercial and residential fronts, too, but we think some of this may be due to the Viessmann acquisiton.)

Now, is this good? Is this outsized growth compared to peers? We’re not sure, and continue to look for more sources to better understand. However, CBECS reports that 202,000 commercial buildings have at least 1 chiller. (Up from 163K commercial buildings in the 2012 CBECS.) The US market is very likely the largest market for chillers, but isn’t the only market. Moreover, many buildings likely have more than a single chiller (especially true for institutional settings, large commercial office buildings, etc.). And, there are many industrial applications for chillers. All this said, we do suspect that 20 percent growth in chillers outpaces the market, though likely still leaves Carrier as a minority player compared to Trane and York.

Finally - why are chiller sales so important? We believe that this is one of the main targets of the OEM cloud based platforms - such as Carrier Abound, JCI Open Blue, and Trane Connect. Moreover, the ROI of a technology-enabled monitoring solution for chillers is solid, makes sense as a bundled offering from the OEM, and also can mitigate the labor shortage by augmented technicians. In fact, in 2022 Carrier cited a 20 percent attach rate for its connected chiller offering. That has grown to 45 percent in 2024, with a medium-term goal of 65 percent. It’s likely that a building owner is going to wrap more services around chillers than around, for example, RTUs.

Honeywell’s CEO on its Q4 2024 call noted this concept most succinctly: “All automation follows the business model of creating installed base and mining that that installed base through services and software.” All of these industry OEMs have had services businesses for a long time - now they are making these offerings more software enabled.

Capital Efficiency Analysis: Feedback

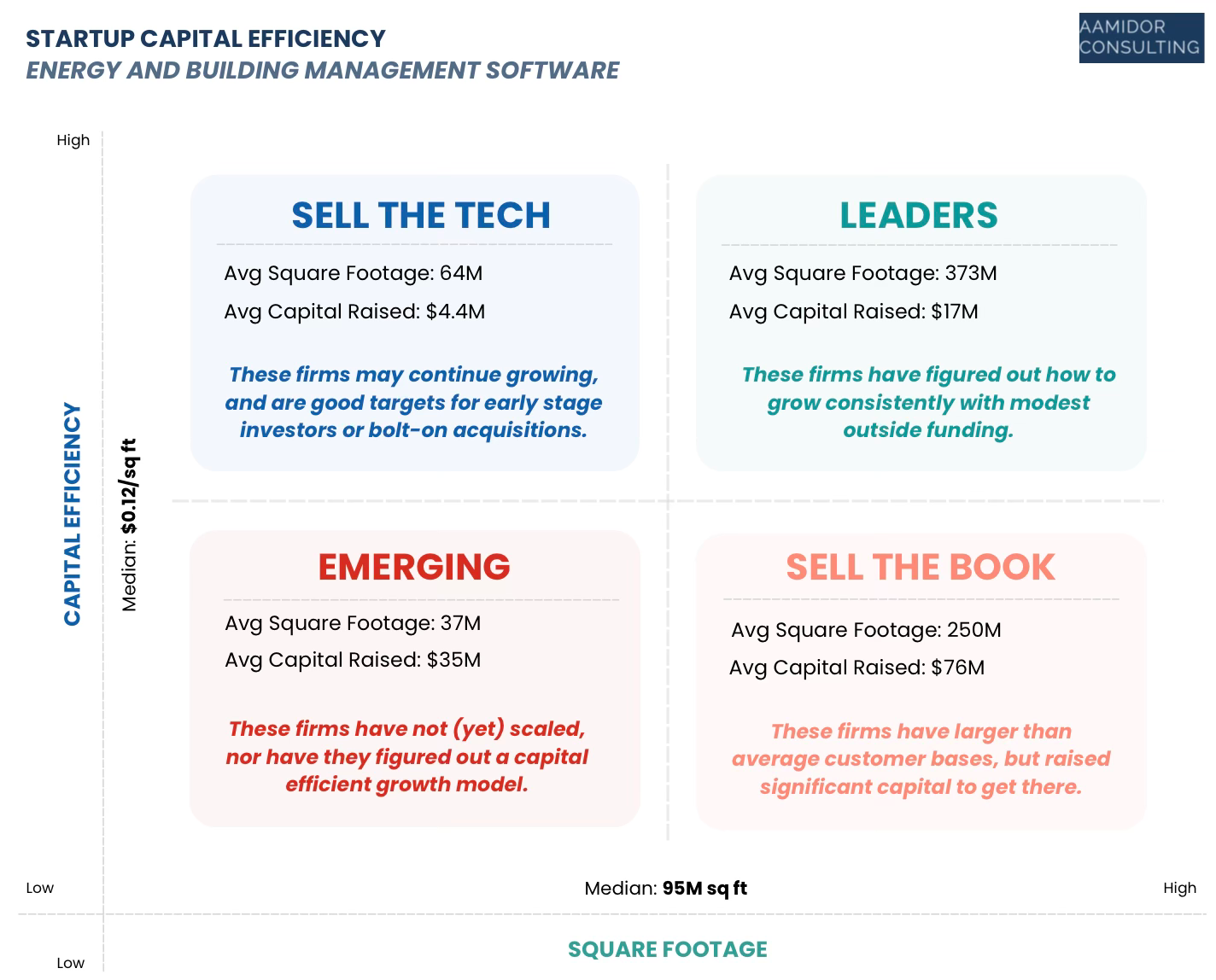

It has been about 2 weeks since Shaun Stewart and I published our energy and building management startup capital efficiency analysis. In case you missed it, see this newsletter issue, this letter in Thesis Driven, and this Down Low with Joe podcast episode, in addition to plenty of LinkedIn posts.

First, we invite more startups to provide the two key metrics: funding raised and total square feet deployed. And, rest assured, we aren’t disclosing specific vendors, simply using the cohort data to provide a wider analysis on the market.

We’re also happy to speak to other market participants (users/buyers, investors, acquirers) that want to know what this means to them.

And, we also want to share some key feedback we’ve received from newsletter readers, consulting clients, and others:

Software buyers and users absolutely see the market fragmentation - a key takeaway from our research. They generally note the negatives of having too many firms to diligence and select from.

Digging in more, one smart buildings leader with significant experience with smart building technology compared this market to street vendors in populous cities - here you find many vendors selling the same thing. But, there must be demand because all of the street vendors continue to operate. That’s a good analogy, but it also is why most street vendors are single-stall, just as many smart building vendors have some scale, but not enough to be a market leader. They all sell basically the same thing, and tend to win based on being the first to be discovered. In some ways, this gets back to the old debate - “is this industry right for venture capital?”

Vendors generally support this research and we received multiple compliments on using available data to provide a cogent summary. We also heard from some vendors who noted that they probably are on the wrong side of the capital efficiency equation, or see opportunities to continue to grow organically. As we mentioned in our post, there certainly are firms that are trying to differentiate by focusing on a specific vertical, too.

One market observer agreed with our thought that there is “sand in the gears” of this market. That leads to two potential outcomes:

Option 1: The market continues to be fragmented with many mildly successful firms, and a few leaders.

Option 2: The market begins to consolidate, but primarily based on a few first movers initiating the consolidation and the rest of the firms trying to catch up.

We did note a few weeks ago that firms may struggle is they are left behind in a new competitive landscape - though that does not appear to be a risk shared by many vendors (at least not yet).

We also heard a few valid questions that we plan to cover in future issues:

How does a firm move into the leader quadrant?

In short, there needs to be some differentiation, on the value front, or where that value is delivered (e.g., by asset class). We don’t believe that a more public presence and greater market recognition alone can do it.

Why would smaller firms not sell?

In short, there are plenty of smaller firms that can continue to operate and deliver value to clients. The key appears to be focusing on a specific approach (type of product, type of end user, etc) and remaining capital efficient. These companies should continue to have options moving forward. At the same time, there are some smaller firms that probably should sell - and we plan to dig into that more.

Lastly, we remain on the fence about more M+A and consolidation in this market. On one hand, this would be a good outcome for market maturity. It also would help buyers more effectively find and deploy compelling technology. But, we haven’t seen much acceptance from vendors of our more direct recommendations for firms in each category.

Follow up on enterprise decarbonization analytics (EDA)

Joe is presenting at Realcomm on decarbonization software solutions. This builds on last year’s post about enterprise decarbonization analytics.

Below we lay out the notable M+A over the past few years that fits into one of two approaches - both moving closer towards more robust EDA offerings:

Major HVAC/controls OEMs seek CMMS solutions to better understand condition of equipment and support capital planning. This broadly supports better lifecycle services (see above), but it also helps fulfill an EDA-aligned value prop.

CMMS firms seek to offer energy / carbon management as another set of capabilities. While energy and carbon management is a clear bolt-on set of capabilities to these firms, they do have a range of capabilities that will enable them to offer EDA, or “capital planning with a net zero lens”.

We plan to continue to focus on this emerging segment, and will share further thoughts and developments as they occur.

Industry Resources

Aamidor Consulting offers a few up-to-date resources to help smart building stakeholders monitor the market:

M&A Tracker: A list of relevant transactions.

Partnership Tracker: A summary of all the partnerships and alliances announced.

See our homepage to learn more about our the full breadth of our offerings.

Aamidor Consulting provides product and GTM expertise to the real estate industry, with a focus on innovators with solutions that decarbonize and digitize commercial buildings. Our typical clients are startups, capital allocators, and industry incumbents - elevating the product and GTM approach and helping to make educated investment decisions. In addition this leading newsletter, we have an unrivaled network of owners and operators and a deep bench of consulting partners. See a summary of our past projects and also a description of our consulting services for more details on how we can help.

Follow us on LinkedIn for more content - and, if you are interested, here are all the articles we've published. Moreover, check out recordings of our weekly issues of the “Down Low with Joe” on Youtube.